Kent’s housing paradox: Kent’s housing is getting more expensive whilst wages lag behind

Kent housing is getting more and more expensive, whilst wages are stagnant. Soon, many people’s dream of owning a home in Kent will never become reality.

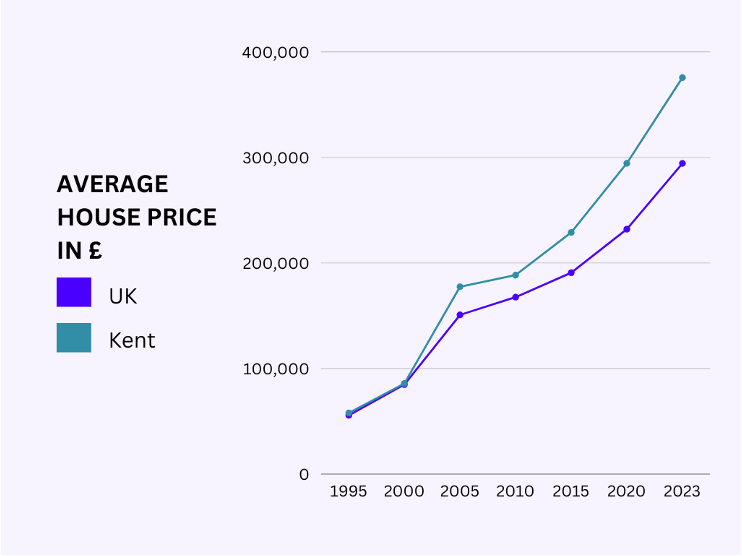

According to data from the Office for National Statistics, the average house price in Kent is a staggering £386,000, almost £100,000 higher than the UK average. However, whilst the average Kentish house price is 34% higher than the UK’s average, the Kentish wage is only 9% higher. This disparity in house price and income means that owning a home in Kent is much harder than in the rest of the UK. However, could recent drops in house prices give a glimmer of hope to those who want to live in the Garden of England?

First, the reasons for Kent’s high house prices but be examined. One reason proposed by local estate agents is that the massive demand for housing is not being met. Spencer Fortag, a property developer with 30 years in the industry, told Kent Online: “There is an absolute shortage of properties to buy in Kent”. Many people seek the coastal lifestyle with easy transport links to London, yet new homes are not being built. According to data published by the Department for Levelling up and analysed by Kent Online, between 2018 and 2021, only 3 of Kent’s 13 authorities met housebuilding targets set by the government, with 5 authorities receiving sanctions for failing to reach 75% of the target. According to the Maidstone Council budget released in February of 2023, a quarter of the 8% council staff pay rise will be funded by a £400,000 housing development grant provided by the government. The council hopes to recoup this money through a 3% household tax increase, further increasing the cost of home ownership in Kent whilst only speculatively hoping to be able to afford new housing, and demonstrating the role of authorities in driving up house prices.

However, it may not all be doom and gloom for Kent’s housing market. According to number released by property advice service PropCast, interest in buying houses in multiple areas across Kent within Tonbridge and Ramsgate has fallen by over thirty percent in the past year, and interest within other areas such as Canterbury and Dover has fallen by over 25%. Whilst supply may be low, demand is also falling, which is causing an overall drop in house prices. In fact, average Kentish house price has dropped by around 0.7% Kent, indicating that buying a house is getting cheaper. One reason for this low demand may be the extremely high price of housing. The average house price in Kent jumped by £40,000 between 2020 and 2021, almost as much as the previous 3 years combined. This spike in house prices has likely driven away buyers, causing demand to drop in 2022 and allowing the housing market to normalise.

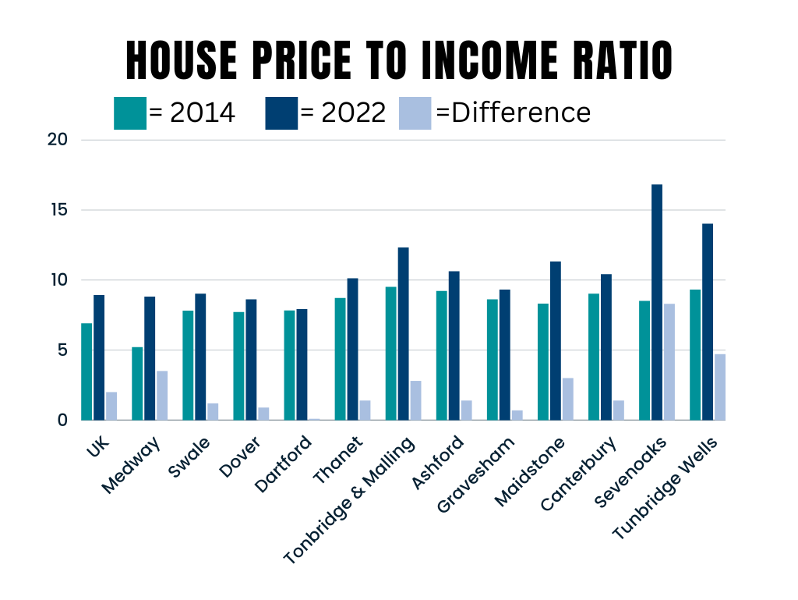

Whilst it may seem contradictory, falling house prices does not mean it is easier to buy a house in Kent than in the rest of the UK. The house price to income ratio in the UK grew by 2.0 between 2014 and 2022, whilst in Kent it grew by 2.45. Despite house prices dropping, wages in Kent are not rising sufficiently to close the gap, meaning that in real terms it is getting harder to afford a house in the county. This is in spite of the fact that overall, Kent workers on more on average per week than the rest of the UK. Data released by Kent Council shows that Kentish workers were earning £19 more per week than the rest of the UK in 2022. However, that £19 is still nowhere near enough to make a house in Kent affordable, and Kent continues to fall behind the rest of the country in terms of purchasing power.

The housing market is a deeply volatile, almost impermeable monster of ever fluctuating prices and speculations. However, whatever the justification, house prices in Kent are rising whilst wages are falling behind. Owning a house in Kent is getting further and further out of reach, and authorities are either unable or unwilling to help. Even with demand dropping due to hostile conditions, prices aren’t falling fast enough and wages aren’t rising high enough to entice buyers back in, and soon Kent’s unsustainable housing model may stagnate the entire county.