UK property price slump does little to quell housing crisis- though Medway bucks trend

By Alex Crean, reporter

By Alex Crean, reporter

UK house prices fell 1.4% in September, the second consecutive monthly fall, and the largest since April. In a poll by Reuters, economists had forecasted a 0.2% rise. Average UK asking prices now standing at £225,995.

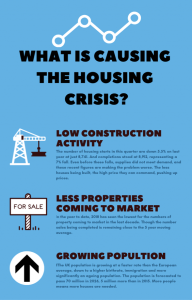

While the monthly figure shows significant cooling in the property market, the annual increase in the year to September still stands at 2.5%. While this represents a fall from August’s wage-busting 3.7% the figure is still contributing to the national housing crisis.

In the release from Halifax, its Managing Director, Russell Galley said: “The annual rate of growth is near the top of our forecast range of 0-3% for 2018 as a low supply of new homes and existing properties for sale, combined with historically low mortgage rates and a high employment rate, continue to support house prices”.

However, in Medway, local property expert Craig Sullivan, sees a different picture.

Mr Sullivan says the national fall is down to slowing demand in London and other parts of the south-east with Medway still attracting demand.

“A reason Medway is bucking the trend is because prices are starting from a lower base than in the rest of the South East, meaning buyers are being attracted to the area, which then pushes up prices.

“Increases in new developments in the area is pushing up prices in two ways, the first being that the new projects are high spec and energy efficient, and then leading on from this because of the high price point making the lower priced properties more demanded. And high demand leads to higher prices in the stock.”

Cllr Vince Maple leader of the opposition Labour party on Medway council agrees that the area’s prices are growing faster.

Cllr Maple said: “There is an acronym taking off in the area, DFL, which means down from London, which is where we are seeing lots of our buyers coming from.

“As more people move in, prices rise, and as they are from London, where prices are higher, the properties being built for them are more expensive.

“We are seeing more properties called affordable, but they aren’t affordable for a lot of people round here, they’re affordable for DFL’s”.

Cllr Maple says that despite Medway’s construction boom, there is still a shortage of supply in Medway, and while the private sector is building, there is still a lot to be done, “House building is good for the area, in terms of supporting the economy, while helping to meet demand.”

Estate agent Craig Sullivan says whether rising house prices are positive or negative depends on people’s circumstances, “If you are selling your home, you want to see prices rise, but if you are trying to get on the housing ladder, rising prices don’t help.”

Although Medway is rare for its rising prices, just because prices are beginning to stutter elsewhere doesn’t mean that it is getting easier for first time buyers.

Recent first-time buyer Jilly Kelly had struggled for many years to get on to the housing ladder due to property prices rising more quickly than her wages.

Miss Kelly, a teacher, said: “Once upon a time teaching was considered an affluent profession, like lawyers and doctors, but now we’ve slipped back in terms of wages.”

Unsurprisingly, Kelly sees a solution to the crisis through education, saying: “Teaching life skills such as saving, budgeting and understanding mortgages are really important, and aren’t often taught. There are so many many types of mortgages, the whole system is quite confusing”.

With uncertainty in the outcome of Brexit it is hard to predict where prices will go next, and in turn who that will benefit, as economists had forecast a rise for September that did not materialise.