Unilever ditches Dutch move in face of investor revolt

by Alex Crean, reporter

by Alex Crean, reporter

Anglo-Dutch Marmite maker Unilever has abandoned plans to shift its headquarters from London to Rotterdam in the Netherlands.

The proposed move had been seen as a response to Brexit and an attempt to secure the consumer products company from foreign takeovers.

The concern over foreign takeovers has been growing in the City due to the weakness of the pound making UK companies cheaper for overseas investors.

The move to the continent would have stopped take over fears due to antiquated Dutch protectionist laws.

In a statement to investors before markets opened this morning, chairman Marijn Dekkers said the company still believed simplifying the company’s shareholder structure was in investors best interests.

In a statement the company said: “The board will now consider its next steps and will continue to engage with our shareholders”.

The company that also produces Ben & Jerry’s ice cream is a constituent of the FTSE 100 with a market cap of £124 billion.

The HQ move would have led to the company having to withdraw from the UK index, meaning some UK investors would be likely to ditch their holdings in the firm.

Yevaan Sahagian a finance and investment manager said: “UK investors were strongly opposed to the move, and as they hold large parts of the company their voice was heard by the board.

“If the move had gone ahead the London de-list would have meant that some shareholders would have had to sell their shares as many funds have rules that only allow them to invest specifically in UK indices.

“This would have led them to be forced to sell their holdings at a lower price than they expected, leading to reduced returns for their own investors”.

The company’s complex shareholder structure dates back to the 1930’s when Dutch food producer Unie merged with British soap maker Lever Brothers- creating the company’s varied product portfolio.

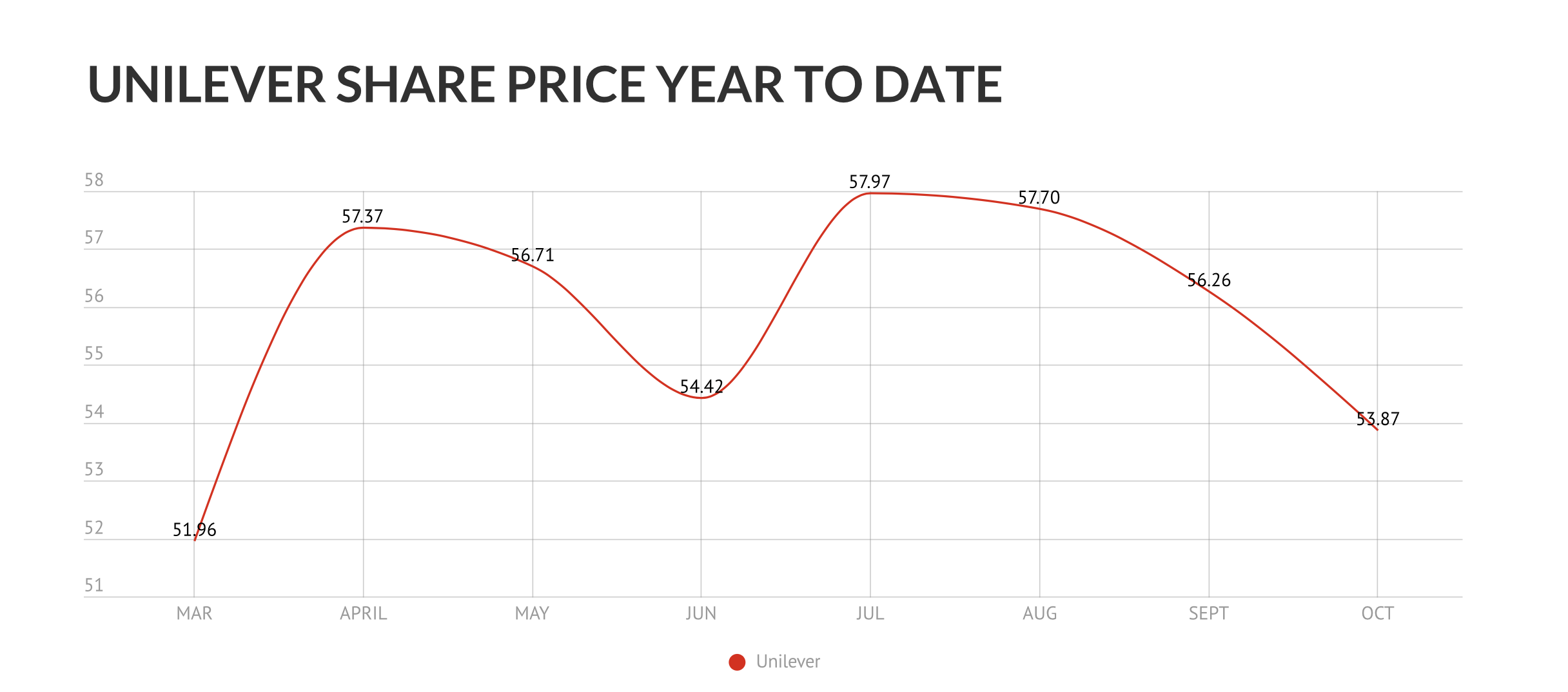

City investors had been expected to welcome the move, although market reaction has so far been negative, with shares trading down 0.81% at £40.45 in mid-morning trading.