Annual inflation rate expected to rise to to 3% next year

Fiona Davis, a flight attendant at Stansted, is one of many family bread-winners struggling to make ends meet

The UK’s inflation rate has risen to 1% in the last month, and is expected to rise to 3% by next summer, hitting low-income families worst.

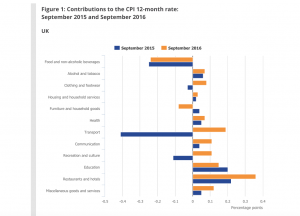

Along with the fall in value of sterling, it is expected to come through in the price of food and petrol most of all.

This comes after Mark Carney, governor of the Bank of England, said that he was willing to see an ‘overshoot’ of his 2% inflation rate, provided it helped growth and protected jobs.

Larry Elliot, the Guardian’s economic editor, warned that the cost of living in Britain is ‘certain to increase noticeably over the next 12 months and is likely to peak at about 3%, perhaps even a bit higher.’

He echoes the sentiments of the Institute for Fiscal Studies (IFS), who say that over 11 million households will be £360 worse off if inflation rises to 2.8% in the next few years.

It warns that lower-income families will be even worse off, at £470 a year.

Fiona Davis, a flight attendant at Stansted and mother, talked to us about struggling with the high cost of living in the UK: ‘I frequently find a week after payday I’ve literally got hardly any money to play with, and two weeks before my next payday I’ve got a pound in my bank account.’

When asked about how she will handle the cost of foreign goods raising, she was far from comfortable: “I hadn’t worried about it until you asked, but thinking about it almost every food that’s packaged comes from abroad.”

In the age of globalism and de-unionisation, most central banks have had to deal with the “death of inflation” – fearing deflation rather than anything rising.

Yet this is not the case for Britain. As the pound has fallen dramatically against the dollar – 20% since the Brexit vote – rows such as that between Tesco and Unilever over the cost of goods such as Marmite have occurred.

The row is unlikely to be the last. Howard Archer, chief economist at IHS Global Insight, called it nothing but a ‘taste of things to come’, as ‘price pressure [was] building up down the supply chain.’